Capital Gain Tax and Stamp Tax on Trading Securities

In 2014, the Egyptian Income Tax Law No. 91 for 2005 (“Income Tax Law”) was amended to apply capital gain tax (“CGT”) on the gains realized from the disposal of shares. The tax rate differs depending on the shares being a listed or unlisted, and the shareholder being resident or non-resident. Also, the Stamp Duty Tax Law 111 of 1980 (“Stamp Tax Law”) was amended in relation to share sale and purchase agreements.

On August 2021, the Ministry of Finance issued Ministerial Decree 428 of 2021 with a guidance on the capital gain tax rates and the stamp duty on disposal of shares. The guidance reiterated the sequence of the several amendments to the tax rates and clarified the compliance procedures.

Capital Gain Tax

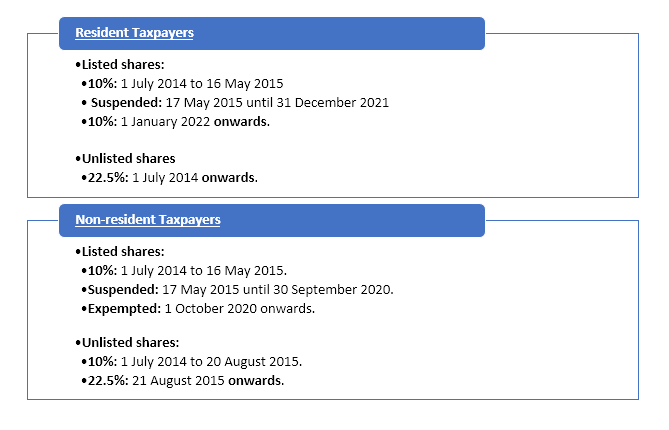

Currently, unlisted shares for both resident and non-resident taxpayer are subject to CGT at a rate of 22.5%, while listed shares for resident taxpayer is subject to CGT at the rate of 10% and exempted for non-residents.

Below is a summary chronology of the capital gain tax amendments:

Stamp Tax

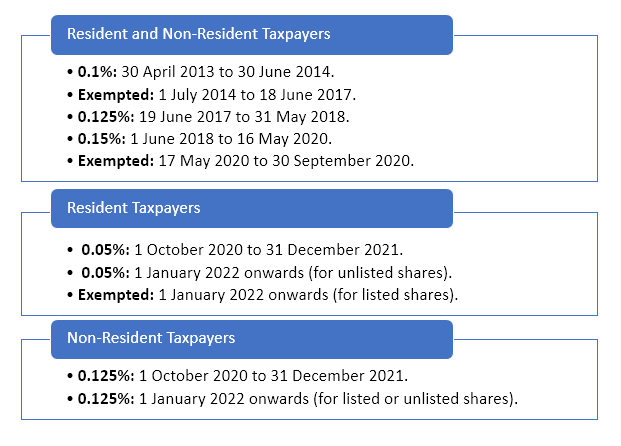

In relation to the stamp duty tax, starting form 1st of January 2022, the tax applies at the following rates:

Resident Taxpayers:

- 0.05% for unlisted shares.

- Exemption for listed shares as long as the transaction is less than the acquisition threshold of 33% of the company’s shares.

Non-resident Taxpayers

- 0.125% for non-residents (listed or unlisted).

Stamp tax does not apply for quotas of limited liability companies, treasury bills, and treasury bonds, or for spot transactions.

Below is a summary chronology of the Stamp Duty Tax Amendments:

How the Capital Gain is calculated?

Capital gains are calculated on the basis of the portfolio’s net profit by the end of the tax year. Net profits are calculated as the difference between the disposal price of the shares and its acquisition price in addition to the commission fees. The collection of this CGT will be on Misr for Central Clearing, Depository and Registry (MCDR) for the individual investing in the stock market so that they will not need to open a tax file in this regard.

Capital losses can be deducted from the capital gains arising during the same tax year, provided that they both arise from the sale of shares from the same pool (i.e. gains and losses of listed shares are in a separate pool from the gains and losses of unlisted shares). Excess capital losses that exceeds the capital gains during a tax year can be carried forward for a period of three years and should be deducted from the capital gains.

What about Dividends?

Dividend income is subject to a flat withholding tax (WHT) that differs in relation to the status of the company distributing dividends in terms of listing in the EGX. As the listed company shall pay 5% flat tax from the dividends distributed and the unlisted company shall pay 10%. The WHT does not differentiate between a resident and non-resident shareholder.